[ad_1]

BUENOS AIRES: Argentina‘s peso opened down 54.24% at 801 per dollar on Wednesday, following a devaluation of the currency carried out by the country’s new government as part of its economic shock therapy aimed at fixing the economy. The South American nation will also cut energy subsidies and cancel tenders of public works, new economy minister Luis Caputo said a day earlier.

Caputo said the plan would be painful in the short-term but was needed to cut the fiscal deficit and bring down triple-digit inflation, as he unveiled a package of measures after libertarian and self-proclaimed “anarcho-capitalist” President Javier Milei took office on Sunday.

The South American country is suffering 143% annual inflation, its currency has plunged and four in 10 Argentines are impoverished. The nation has also a yawning fiscal deficit, a trade deficit of $43 billion, plus a daunting $45 billion debt to the International Monetary Fund, with $10.6 billion due to the multilateral and private creditors by April.

Caputo said the country needed to tackle a deep fiscal deficit he put at 5.5% of GDP, adding Argentina had a fiscal deficit for 113 of the last 123 years. “We’re here to solve this problem at the root. For this, we need to solve our addiction to a fiscal deficit,” he said. “I welcome the decisive measures,” IMF chief Kristalina Georgieva said, calling it “an important step toward restoring stability and rebuilding the nation’s economic potential.”

The IMF called the measures “bold” and that they would “help stabilise the economy and set the basis for more sustainable and private-sector led growth” following “serious policy setbacks” in recent months. Since 2019, Argentina’s peso has been kept artificially strong by strict capital controls which create a wide gap between the official exchange rate of 366/dollar and parallel rates as high as 1,000/dollar.

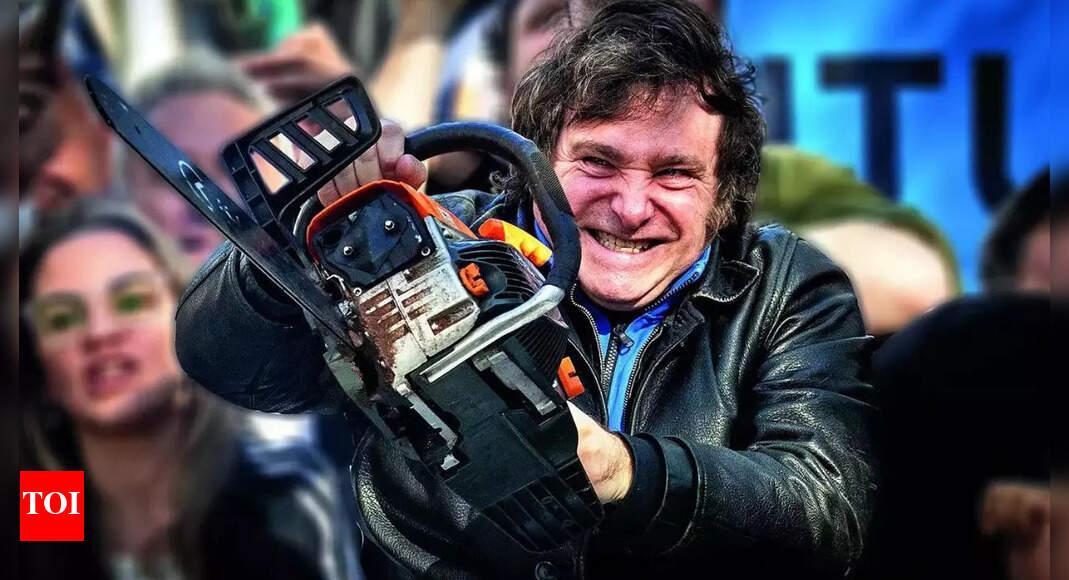

Milei, a wild-haired political outsider, had campaigned with pledges for major spending cuts, often wielding a chainsaw at rallies as a blunt symbol of his plans to trim back the state. His tough fiscal rhetoric – with a new mantra “there is no money” – has buoyed markets.

But the key doubt is whether Milei, whose libertarian coalition is only the third largest bloc in Congress, can implement the sharp cuts needed to undo the deep fiscal deficit without pushing the country towards turmoil and unrest. “The adjustment will be painful, and the path forward is laden with economic, political & social risks,” Fitch Ratings said.

Caputo said the plan would be painful in the short-term but was needed to cut the fiscal deficit and bring down triple-digit inflation, as he unveiled a package of measures after libertarian and self-proclaimed “anarcho-capitalist” President Javier Milei took office on Sunday.

The South American country is suffering 143% annual inflation, its currency has plunged and four in 10 Argentines are impoverished. The nation has also a yawning fiscal deficit, a trade deficit of $43 billion, plus a daunting $45 billion debt to the International Monetary Fund, with $10.6 billion due to the multilateral and private creditors by April.

Caputo said the country needed to tackle a deep fiscal deficit he put at 5.5% of GDP, adding Argentina had a fiscal deficit for 113 of the last 123 years. “We’re here to solve this problem at the root. For this, we need to solve our addiction to a fiscal deficit,” he said. “I welcome the decisive measures,” IMF chief Kristalina Georgieva said, calling it “an important step toward restoring stability and rebuilding the nation’s economic potential.”

The IMF called the measures “bold” and that they would “help stabilise the economy and set the basis for more sustainable and private-sector led growth” following “serious policy setbacks” in recent months. Since 2019, Argentina’s peso has been kept artificially strong by strict capital controls which create a wide gap between the official exchange rate of 366/dollar and parallel rates as high as 1,000/dollar.

Milei, a wild-haired political outsider, had campaigned with pledges for major spending cuts, often wielding a chainsaw at rallies as a blunt symbol of his plans to trim back the state. His tough fiscal rhetoric – with a new mantra “there is no money” – has buoyed markets.

But the key doubt is whether Milei, whose libertarian coalition is only the third largest bloc in Congress, can implement the sharp cuts needed to undo the deep fiscal deficit without pushing the country towards turmoil and unrest. “The adjustment will be painful, and the path forward is laden with economic, political & social risks,” Fitch Ratings said.

[ad_2]

Source link