[ad_1]

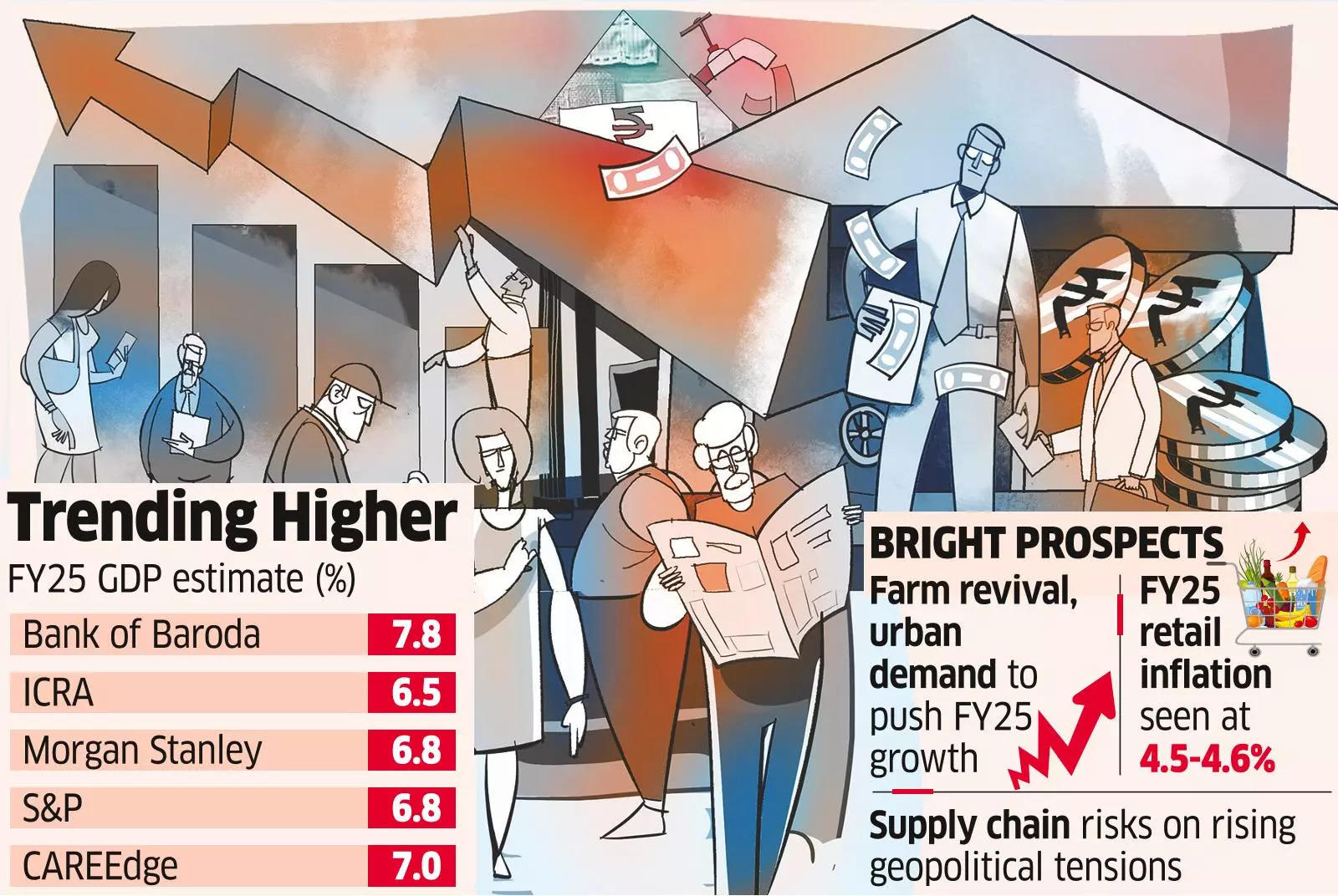

Improved manufacturing, farm activity and robust urban demand could fire up India’s economy, which is expected to clock a 7% growth in FY25, according to economists that cited inflation and restrictive interest rates as key challenges to this growth.

A few economists expect the country to scale up growth to as high as 7.8% in the fiscal year, but said the new government should focus on meaningful job creation. “At 7.8%, growth prospects this fiscal are better than the last based on good monsoons and growth in the agriculture sector. We expect marginal growth in all sectors including manufacturing, which is a laggard,” said Bank of Baroda chief economist Madan Sabnavis.

India’s economy is expected to have grown by 7.6% in 2023-24.

“We expect the economy to expand by 7% in FY25, driven by the government’s sustained focus on capex and strong service sector momentum,” said Rajani Sinha, chief economist, CareEdge. She said the agency expected a broad-based recovery in the rural demand on the back of a normal monsoon, which had already shown early signs of revival.

Both consumption and private investment are seen picking pace with retail inflation expected to moderate to 4.5%. While public capex remains strong, private capex has been on a weak footing except metals and machinery, which have significant government presence.

Morgan Stanley has raised the growth forecast for FY25 to 6.8% from 6.5% estimated earlier, based on continued traction in industrial and capex activity.

S&P Global Ratings also raised India’s growth forecast for 2024-25 to 6.8% from 6.4% predicted earlier but flagged restrictive interest rates as a dampener for economic growth.

“The overhang of a bad monsoon and the YoY decline in commodity prices which supported margins last year are the key challenges to watch out for. Urban demand is expected to stay healthy,” said Aditi Nayar, chief economist at ICRA. ICRA expects GDP growth to slow down to 5.5-5.9% in the first half of FY25, before improving to 7.1-7.2% in the second half, aided by back-ended government capex, a likely pick-up in private capex, and some improvement in export growth.

“Inflation is the biggest risk and low reservoir levels would affect horticulture crops. We expect inflation to rise in the next three-four months,” Sabnavis said.

“Meaningful job creation is key for sustainability of growth, not construction workers and delivery people,” he said.

[ad_2]

Source link