[ad_1]

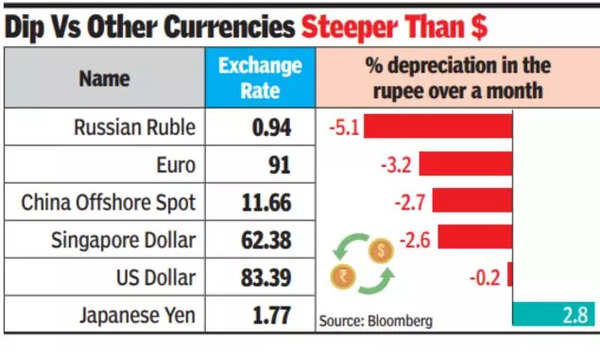

The rupee’s movement against the dollar contrasted with other Asian currencies, which gained with an easing of yields in US treasuries.The euro, Singapore dollar, Taiwan dollar, Thai baht, Chinese yuan, and Malaysian ringgit firmed up against the dollar.

Despite the rupee weakening against the dollar, the stock market continued its rally for the third day – with the sensex reaching a high of 67,069 intra-day.

Besides the apparent decoupling of the rupee movement and the stock indices, another trend seen in recent days is the decoupling of the rupee-dollar exchange rate from other major currencies. The decoupling benefits importers as most of the trade invoicing is in US dollars.

“We expect US dollar/rupee to remain volatile amid sideways movement in the dollar index and key GDP data. If the pair sustains above 83.4, it could test 83.52-83.65 levels while 83.2 will act as support,” said Rahul Kalantri, vice president at Mehta Equities.

Dealers mentioned that pressure on the rupee would mostly be because of demand from oil companies.

[ad_2]

Source link